Best BiDeFi platform in Bitlayer ecosystem

Bringing you BBD - Bitcoin Backed Dollar, the stablecoin backed by the mother of all cryptocurrencies. Exclusive on Bitlayer.

Building a BeDeFi platform on Bitlayer is the breakthrough that Bitcoins DeFi ecosystem has been waiting for.

The future of decentralized finance on bitcoin!

SWAPE & BBD

Bitquity's ecosystem tokens are now live on Bitlayer 🚀

$SWAPE token contract: 0xcE6631222405F7267d6d9Ec71887e56EB8c89CD1

$BBD token contract: 0xA98D4b1951CAC4c51ECd12F2d37a64188f6451FE

Both tokens are listed on Macaron, Bitlayers native DEX.

Unique Use Case

Unlock the full potential of your Bitcoin with BITQUITY!

Earn passive income effortlessly by lending your Bitcoin and enjoy steady returns without ever needing to sell. Tap into instant liquidity by using your Bitcoin as collateral for borrowing, and seize the opportunity to amplify your gains through leverage.

Take your Bitcoin holdings to the next level!

Hedge

- Stabilize investment against market fluctuation

- Hold BTC and other assets in parallel

- Deposit Bitcoin as collateral

- Retrieve Collateral at any time

Leverage

- Amplify your returns by leveraged lending

- Borrow additional funds for investments

- Significantly increase exposure to potential gains

Liquidity

- Multiple stabilization mechanism

- BBD and SWAPE staking pools

- Secure Liquidations and Redemptions

- Multiple user incentives

- Smart Swap Routing

How it works

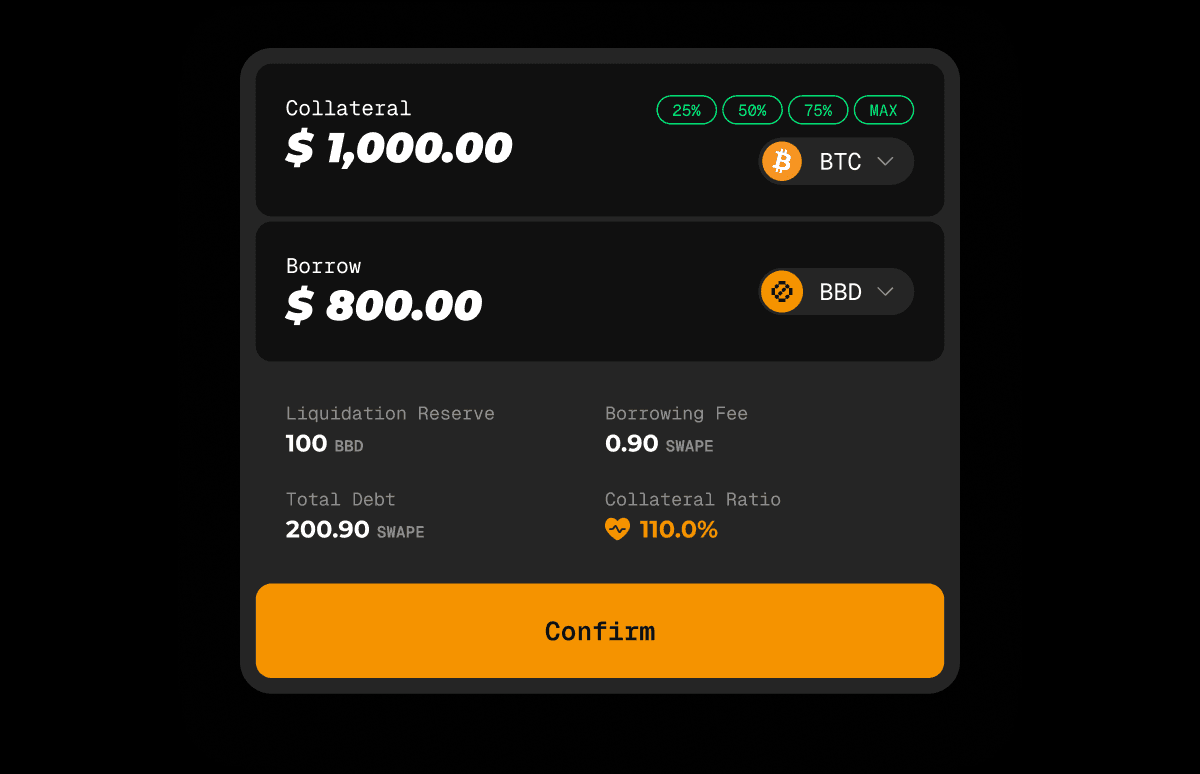

Step 1:

Open Vault

Borrow $BBD with Bitcoin as Collateral. Over-collateralize for more security.

Deposit collateral in Bitcoin, receive borrowed BBD stablecoin

- Collateral must be ≥ 110% of borrowed amount

- Collateral ratio changes with market fluctuation of BTC

- When CR drops below 110%: User’s collateral can be liquidated, but users still keeps the borrowed BBD

- Retrieve BTC collateral by paying back BBD dept

- 0% interest rate

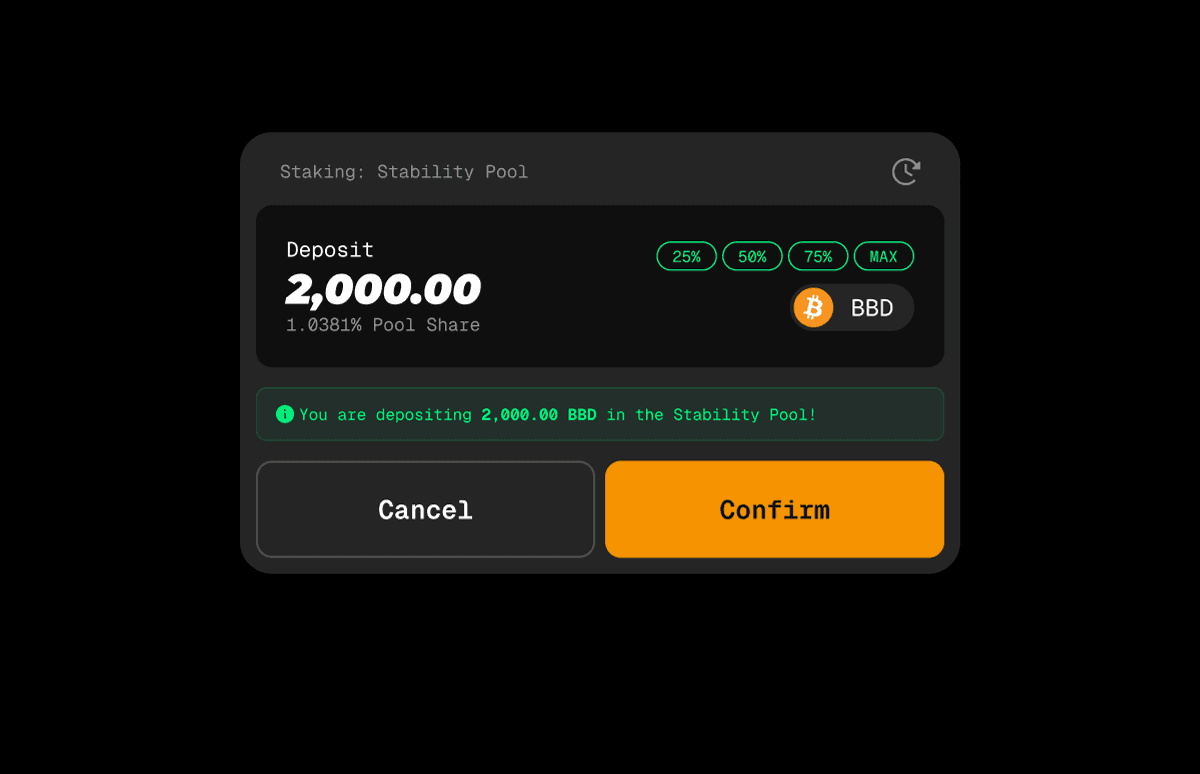

Step 2: Stake $BBD

Stake your $BBD from step one into the Stability Pool to earn and $SWAPE BTC from liquidations.

The Stability Pool is necessary for a healthy ecosystem.

- Incentive to participate and stabilize platform by earning rewards:

- BTC from liquidations

- Constant SWAPE stream

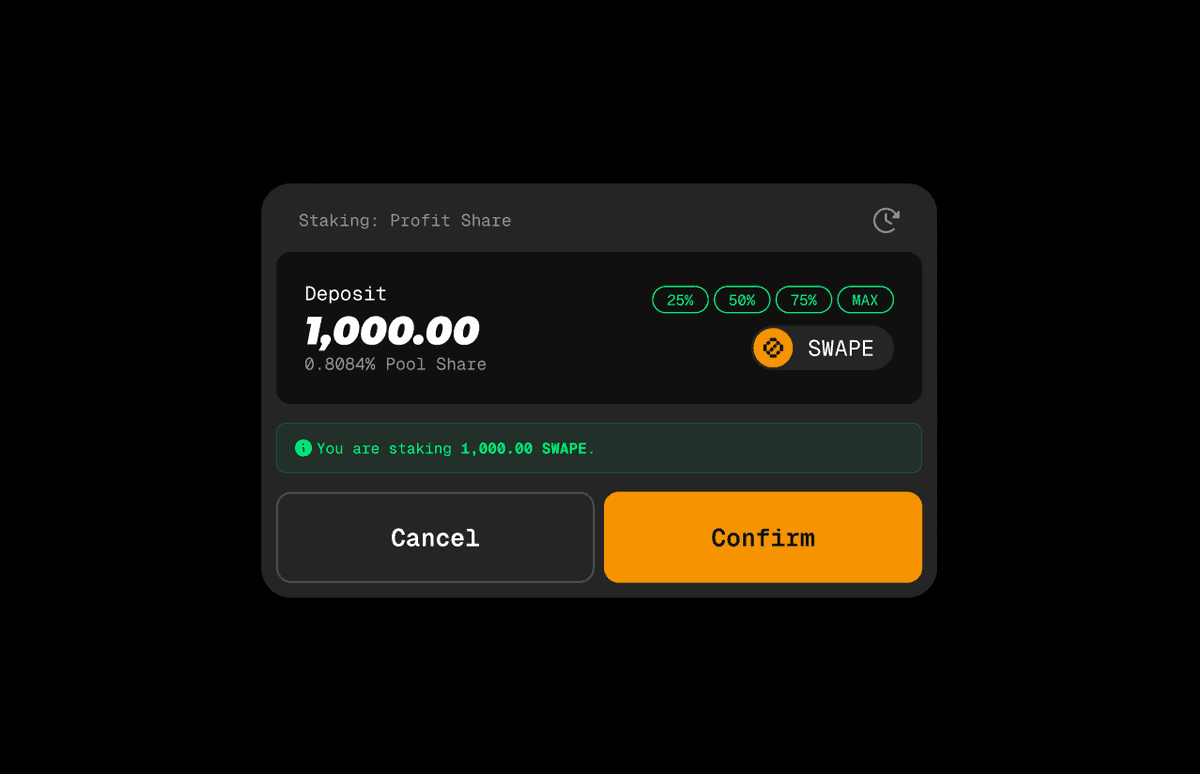

Step 3: Stake $SWAPE

Stake your $Swape now to earn redemption fees and platform fees in BTC.

Staking benefits holders by earning rewards:

- BTC from redemption fees

- 0.5% platform fee

The 0.5% platform fee is paid by the user when opening or increasing a vault.

Ecosystem Explained

BBD

Bitcoin Backed Dollar - the $BBD - is an over-collateralized stablecoin.

SWAPE

$SWAPE is the backbone of the Bitquity ecosystem and our platform token. Stake $SWAPE to earn the borrowing and redemption fees.

Liquity Vault / Vault

The vault is a container for your personal borrowing position. When you borrow stablecoins for the first time, you open a new vault.

Collateral Ratio (CR)

The collateral ratio is the proportion of your BTC collateral versus the borrowed BBD in your Vault. Example: Borrowing 1,000 $BBD while depositing 0.2 BTC (≈ 1500$ worth) as collateral results in 150% Collateral Ratio (CR). Your vault is over collateralized.

Liquidation

When a Vaults Collateral Ratio drops below 110%, it can be liquidated. This means that you will lose your BTC collateral, but you keep your borrowed $BBD. You can avoid this scenario by using (or increasing to) a higher CR while borrowing (150%, 200%, etc.).

Latest News and Updates

Bitquity is Excited to Announce the Official Launch of SWAPE!

The wait is finally over. On December 30, 2024, Bitquity’s utility and rewards token, $SWAPE, will officially be live and available for trading. This marks a major milestone for our protocol as we introduce the key token that will power the rewards system and incentivize users across our ecosystem. Here’s everything you need to know about ...

.png&w=3840&q=75)

.png&w=1200&q=75)